Evaluating a Cash Transfer Benefit to National Housing Trust ResidentsCypress Marrs, Claudia Aiken

|

Between May and August 2022, National Housing Trust (NHT) ran a small-scale, direct cash transfer program which was intended to help stabilize tenants across eight of their twelve low-income housing developments in Washington, D.C.

The Housing Initiative at Penn (HIP) researchers worked with NHT to design and implement multiple surveys of residents. Through intensive outreach, the surveys captured a population that is particularly vulnerable and often hard to survey. The results include important findings about the impact of the COVID-19 pandemic on low-income households, as well as the potential of direct cash transfers to stabilize these families.

The Housing Initiative at Penn (HIP) researchers worked with NHT to design and implement multiple surveys of residents. Through intensive outreach, the surveys captured a population that is particularly vulnerable and often hard to survey. The results include important findings about the impact of the COVID-19 pandemic on low-income households, as well as the potential of direct cash transfers to stabilize these families.

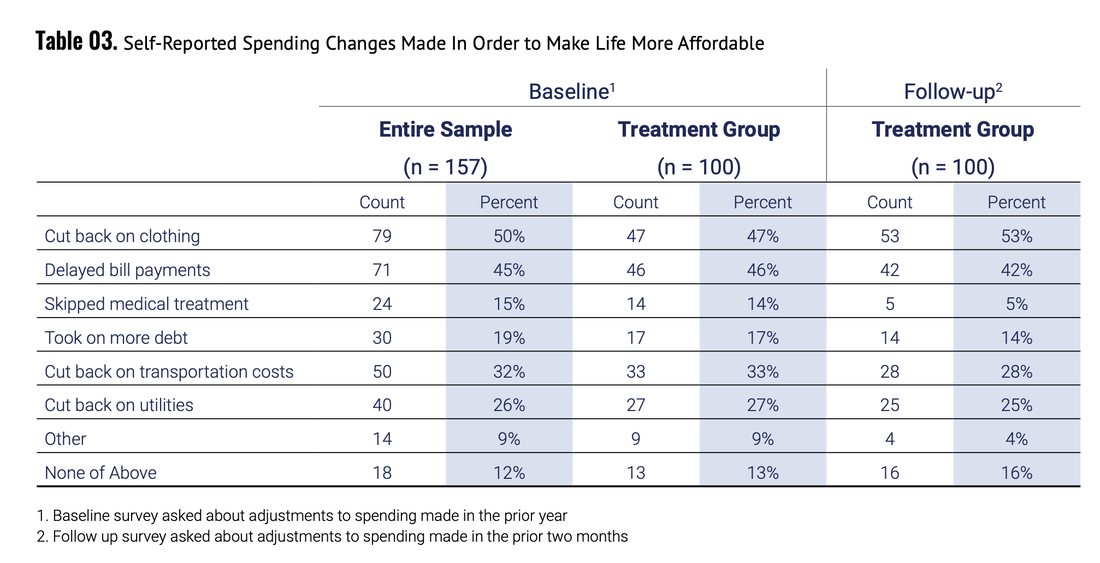

The cash grant was associated with reduced levels of anxiety about housing stability and fewer tradeoffs in health and other household needs.

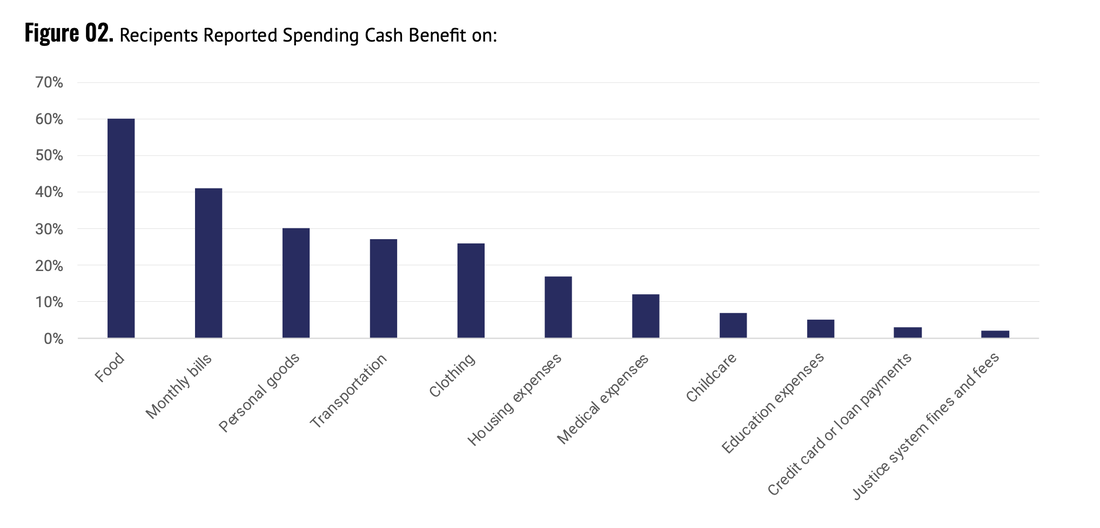

69% of residents who received cash payments reported that this assistance improved their households’ finances and 62% reported that the payments reduced stress. Tenants most often reported using the monthly cash benefit to buy groceries and to help cover their regular expenses. One in five residents who received the cash transfer report that it allowed them to access care that would have otherwise been inaccessible.

69% of residents who received cash payments reported that this assistance improved their households’ finances and 62% reported that the payments reduced stress. Tenants most often reported using the monthly cash benefit to buy groceries and to help cover their regular expenses. One in five residents who received the cash transfer report that it allowed them to access care that would have otherwise been inaccessible.

Tenants with unit-based vouchers experienced less housing instability.

Respondents with vouchers were less likely to report, being behind on rent (28% compared to 50%), borrowing money to pay rent (11% compared to 41%), and applying for StayDC’s rent relief program (22% versus 59%).

Read the whole report here.

Respondents with vouchers were less likely to report, being behind on rent (28% compared to 50%), borrowing money to pay rent (11% compared to 41%), and applying for StayDC’s rent relief program (22% versus 59%).

Read the whole report here.