California’s COVID-19 Rent Relief Program Analysis of Applications, as of April 24, 2022Katharine Nelson, Cypress Marrs, Yihan Zhang

|

California’s Department of Housing and Community Development administers the largest rent relief program in the country.

Between March 2021 and the end of March 2022, one out of ten California renters applied for assistance paying their rent from the State. As of April 24, 2022, the program had spent $2.7 billion; funding 255,269 households; with a typical household receiving $8,700 in rent relief. More than 500,000 households submitted applications and as many as 200,000 more households started but did not finish applications.

Between March 2021 and the end of March 2022, one out of ten California renters applied for assistance paying their rent from the State. As of April 24, 2022, the program had spent $2.7 billion; funding 255,269 households; with a typical household receiving $8,700 in rent relief. More than 500,000 households submitted applications and as many as 200,000 more households started but did not finish applications.

Most applications came from areas and communities with high need.

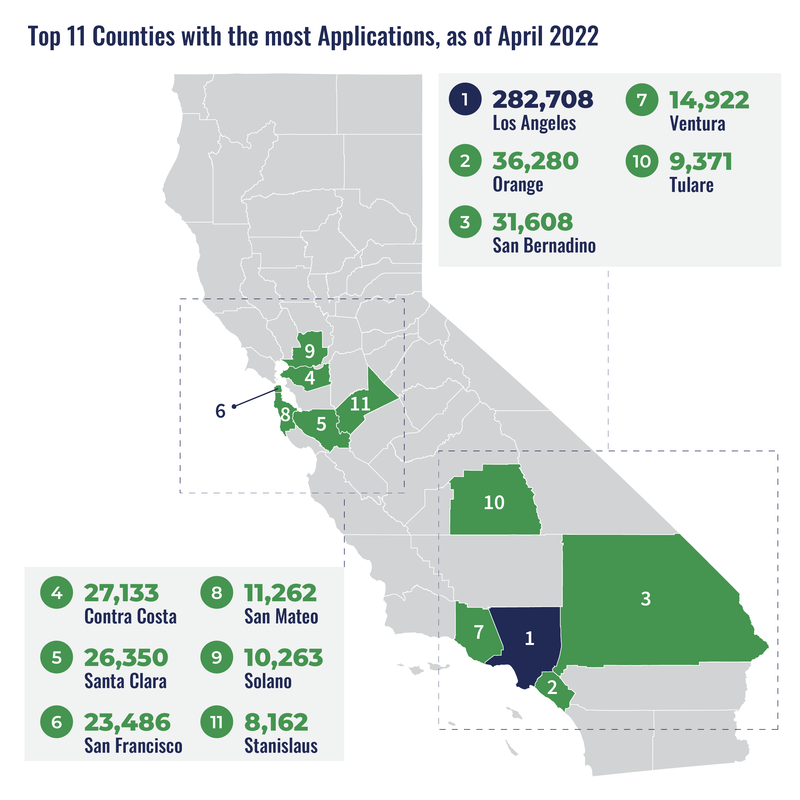

The large majority applications for rent relief came from populous counties in Southern California and the Bay Area. These are areas with moderate or high eviction risk according to estimates by UrbanFootprint.

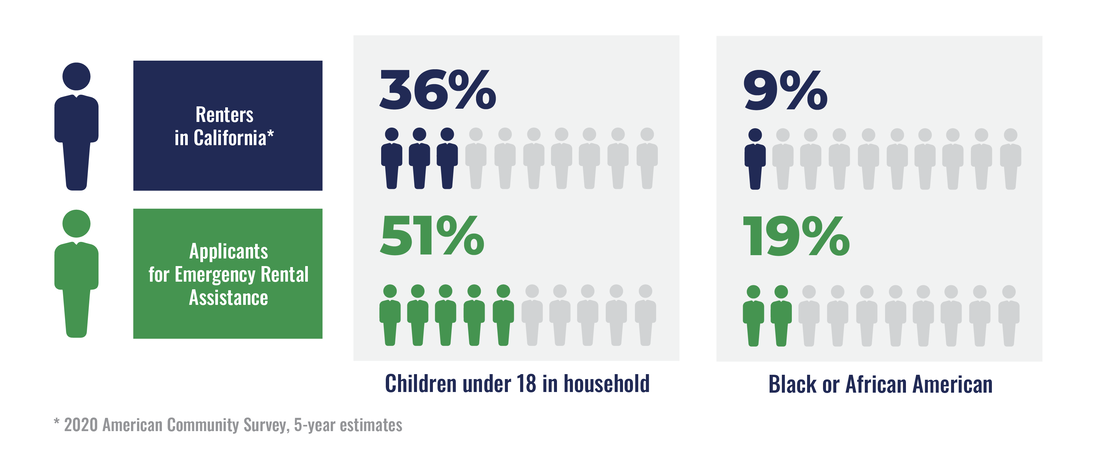

Renters who identify as Black, Native Hawaiian, Pacific Islander, American Indian and Alaskan Native applied for assistance more often than renters with other racial backgrounds. More than half of the households who applied for and received assistance have kids, while only 36% of California’s renter households include children.

The large majority applications for rent relief came from populous counties in Southern California and the Bay Area. These are areas with moderate or high eviction risk according to estimates by UrbanFootprint.

Renters who identify as Black, Native Hawaiian, Pacific Islander, American Indian and Alaskan Native applied for assistance more often than renters with other racial backgrounds. More than half of the households who applied for and received assistance have kids, while only 36% of California’s renter households include children.

Applicants for rental assistance were experiencing a tremendous amount of stress and uncertainty about housing and finances when they applied.

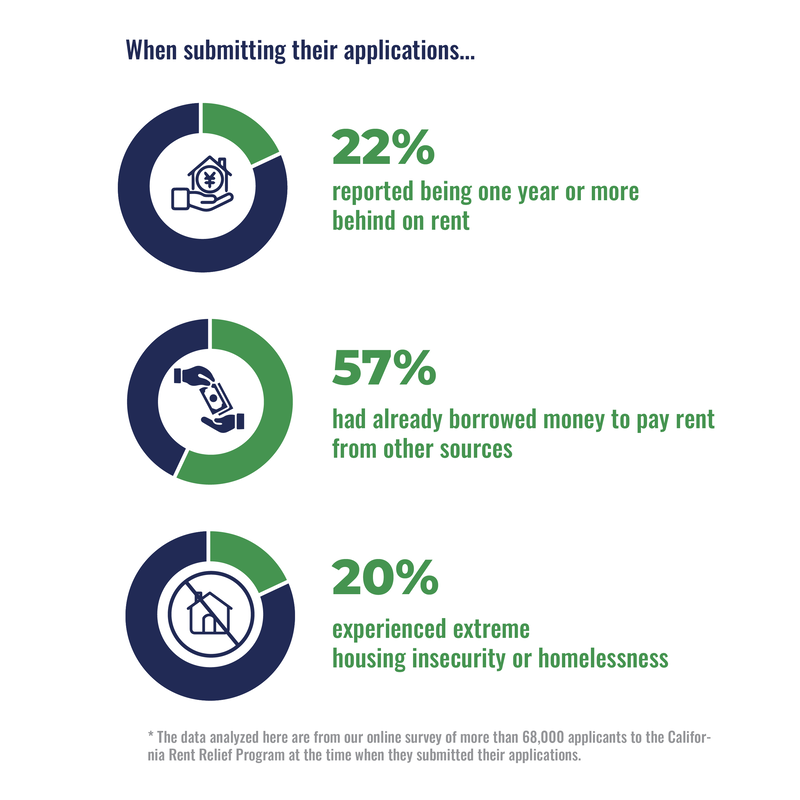

Through our survey of applicants for rent relief, we found that most renters (77%) reported they were behind on rent when they applied for assistance, with 22% indicating they owed more than a year in back rent.

More than half of all applicants had already borrowed money to pay rent (57%) before applying for rental assistance, usually from family and friends.

Twenty percent of survey participants reported some level of extreme housing instability or homelessness since the start of the pandemic. Twelve percent reported couch surfing, eleven percent reported staying in a hotel or motel, and seven percent reported sleeping in a car or van.

Through our survey of applicants for rent relief, we found that most renters (77%) reported they were behind on rent when they applied for assistance, with 22% indicating they owed more than a year in back rent.

More than half of all applicants had already borrowed money to pay rent (57%) before applying for rental assistance, usually from family and friends.

Twenty percent of survey participants reported some level of extreme housing instability or homelessness since the start of the pandemic. Twelve percent reported couch surfing, eleven percent reported staying in a hotel or motel, and seven percent reported sleeping in a car or van.

Applicants who faced more barriers to applying were less likely to receive funding than those who faced fewer.

Renters encountered a variety of challenges—such as having limited internet access or difficulty providing documentation—to accessing rent relief through the program. Applicants who faced more barriers to applying were less to be approved for funding than those who faced fewer of these barriers.

Many renters who faced these barriers to applying may have also been less likely to fill out our online survey or successfully access the application. Our findings may understate the severity of these barriers.

Read the whole report here.

Renters encountered a variety of challenges—such as having limited internet access or difficulty providing documentation—to accessing rent relief through the program. Applicants who faced more barriers to applying were less to be approved for funding than those who faced fewer of these barriers.

Many renters who faced these barriers to applying may have also been less likely to fill out our online survey or successfully access the application. Our findings may understate the severity of these barriers.

Read the whole report here.